Achieve CLARITY & CONFIDENCE

Personalized Holistic Financial Readiness for Military Families

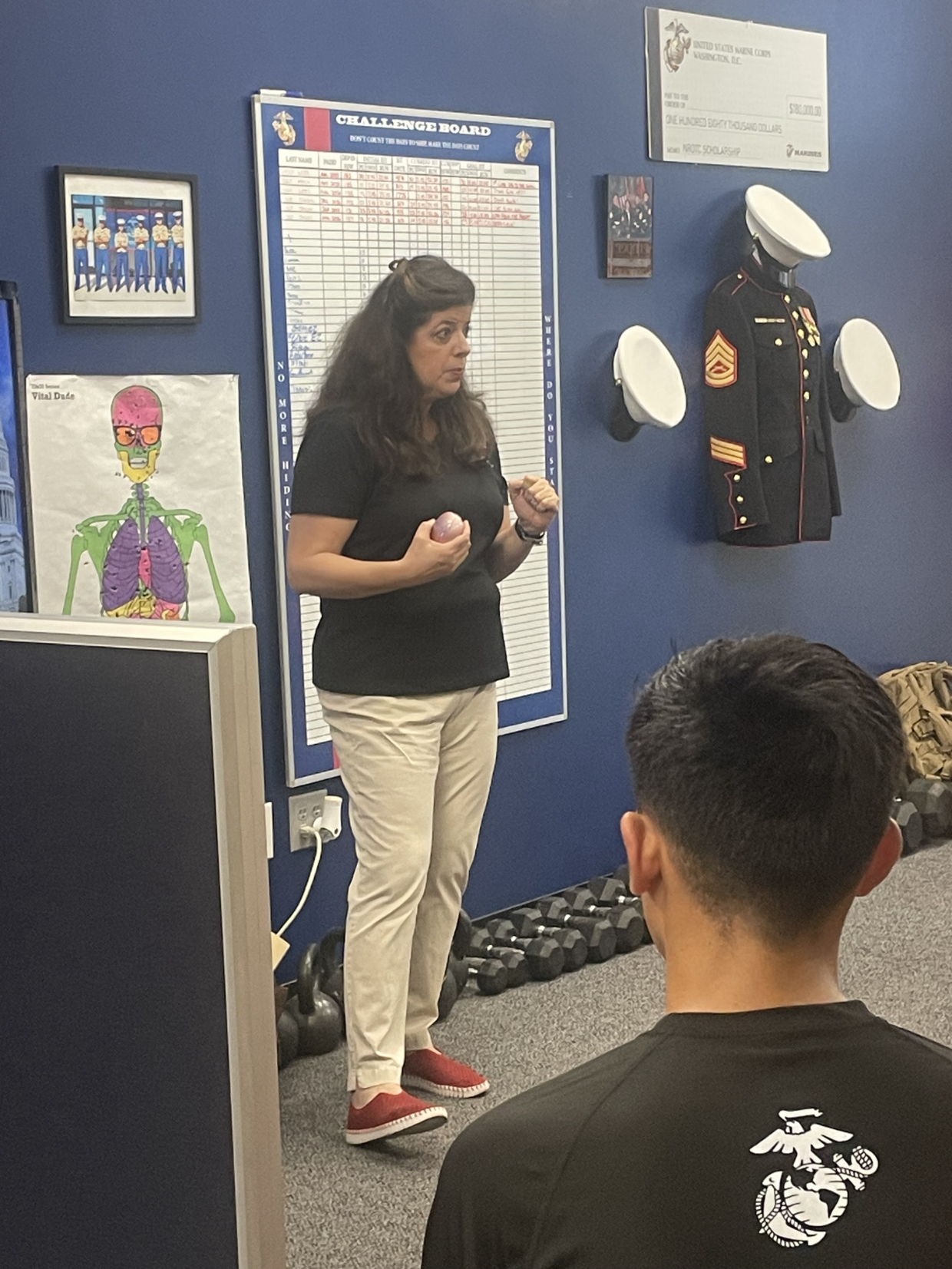

Serving Military Service Members, Veterans and their Families

Your Financial Concierge

From Military Discipline to Million-Dollar Strategy-We’re Your Financial Mission Control.

Your mission was to serve-we help you build, grow, and protect what you’ve earned.

A Fully Integrated Financial Command Center

We don’t offer random financial services—we deliver an elite, concierge-level financial ecosystem designed to create, grow, and protect wealth across every financial arena:

- Financial Planning – Wealth Strategies, not just spreadsheets

- Tax Planning – Minimize liability, maximize freedom

- Investment Planning – Make. Your money work harder than you ever did.

- Retirement Planning – Clarity, confidence, and rock-solid exit plan.

- Insurance Planning – Real protection, real security, zero guesswork.

- Estate Planning – Don’t leave your legacy to chance.

- Education Planning – Build futures through smart funding strategies.

- Business Planning – Sale smarter, exit richer.

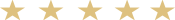

- Financial Literacy Coaching – Empowered decision through expert guidance.

- Real Estate & VA Loans – Leverage the assets you already earned.

- Credit Building Strategies – Optimize your score, unlock your power.

You Can’t Scale What You Don’t Protect.

Most people treat their finances like a checklist. We treat it like a business strategy. Because every financial move you make is either building your future—or costing you everything.

Our mission is simple: to provide guidance to military families, veterans, and everyday entrepreneurs take command of their financial future with elite-level precision.

We serve Leaders Who Want More Than Average.

- Military & Veterans who want to translate discipline into wealth.

- Civilians who are ready for basic budgeting and to move beyond it.

- Small Business Owners looking to scale, protect, and exit with power.

- Families who want to build generational wealth, not generational debt.

Ready to Take Command of Your Financial Future?

Don’t settle for a cookie- cutter plan when you could have a custom, concierge-level strategy built for your life, your legacy, and your long-term wealth.

Book Your Financial Strategy Call Now!

By sending this request, I agree that Lisa Galloway or a financial professional from her team may contact me at the phone number I provided, through a phone or text, even though I may be on a Do Not Call Registry and/or it may be a wireless number. Private Policy and Terms of Condition

We believe financial intelligence is your greatest weapon.

By leveraging clarity, commitment, confidence, and discipline, you can establish a solid battle rhythm for your financial success.

From Military Discipline to Million-Dollar Strategy-We’re Your Financial Mission Control.

With our personal financial guidance, you can unlock your full potential and achieve the financial success you deserve.

A few community partners we serve

Our Services

Financial Planning:

Comprehensive financial plan creation

Financial goal setting and prioritization

Cash flow management and budgeting

Debt management strategies

Investment Planning:

Investment portfolio analysis and management Asset allocation and diversification strategies Retirement planning and investment strategies

College savings planning (e.g., 529 plans)

Retirement Planning:

Retirement income planning

Social Security and pension maximization. Retirement savings strategies Required Minimum Distributions (RMD) planning

Tax Planning:

Tax-efficient investment strategies

Year-end tax planning

Coordination with tax professionals

Strategies to minimize tax liabilities

Insurance Planning:

Life insurance needs analysis

Disability insurance planning

Long-term care insurance

Health insurance review and recommendations

Estate Planning:

Estate plan review and recommendations

Trust planning and management

Wealth transfer strategies

Charitable giving strategies

Education Planning:

Education funding strategies

College savings plans (e.g., 529 plans)

Financial aid and scholarship guidance

Business Planning:

Succession planning for business owners

Employee benefits and retirement plans

Business continuity planning

Specialized Services:

Divorce financial planning

Financial planning for special needs families Elder care financial planning

Wealth Management:

Ongoing portfolio monitoring and adjustments Quarterly or annual review meetings Performance reporting and analysis. Coordination with other professionals (e.g., attorneys, accountants)

Client Education:

Financial literacy workshops and seminars Personalized financial education and coaching Resources and tools for financial decision-making

Real Estate

Real Estate Professionals

VA Loan Specialists

VA Loan Specialists

Credit Building Strategies

Credit Repair